Kampala, Uganda – 8th December 2025

ICT Teachers Association Members (ITAM) Savings and Credit Cooperative Society (ITAM SACCO) successfully convened its 5th Annual General Meeting (AGM) on 8th December 2025 at the Sharebility/ITAM Office, Golden Years House, Kitala. The event also featured an intensive Financial Literacy and Investment Workshop, drawing members together for a day of reflection, learning, planning, and renewed commitment to strengthening the SACCO.

Chairperson’s Opening Remarks

In his welcome remarks, Mr. Wejuli Moses the Chairperson reaffirmed ITAM SACCO’s mission to offer savings and credit services, promote financial literacy, and support entrepreneurship among ICT practitioners and educators. He emphasized the SACCO’s steady progress over the past five years and highlighted achievements such as subscription mobilization, compliance with cooperative regulations, steps toward professionalizing operations, and adoption of digital financial tools.

He also acknowledged the challenges experienced in 2025—particularly the reduced loan portfolio—and urged members to actively utilize SACCO credit products to boost income and strengthen dividends in future cycles.

Interactive Session on ICT-Enhanced Savings and Investment

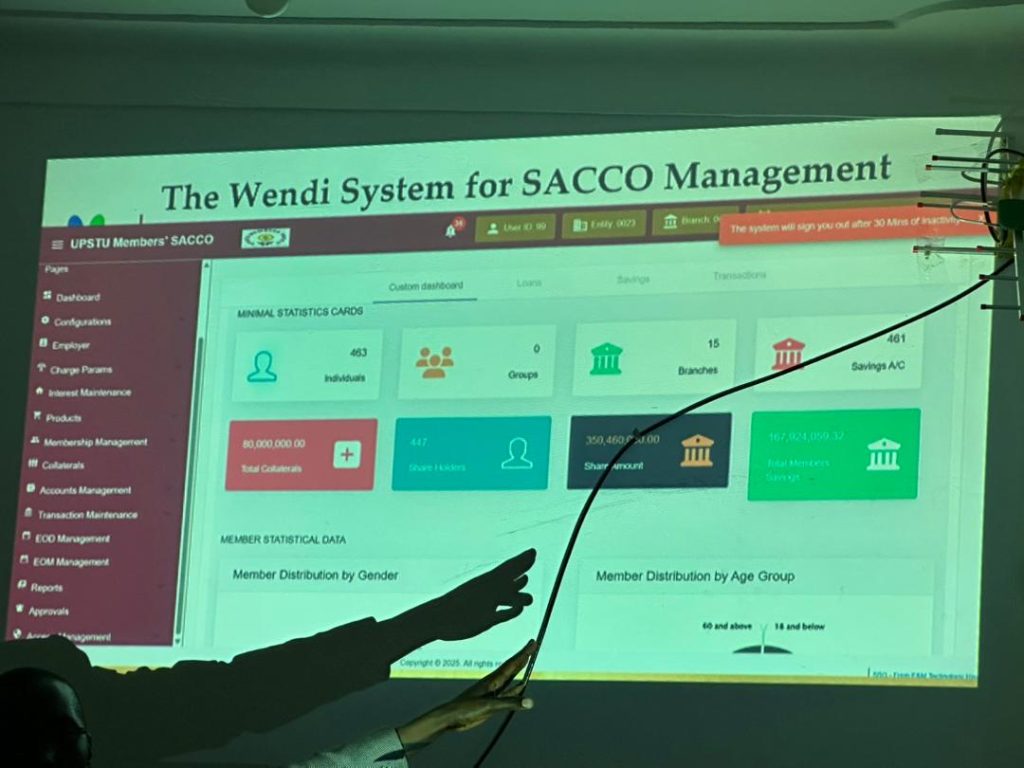

Presented by: Mr. Mukooba Richard, Manager – UPSTU Members’ SACCO

A major highlight of the AGM was the engaging and practical financial literacy session facilitated by Mr. Mukooba Richard, who delivered a comprehensive presentation on ICT-enhanced savings and investment opportunities for teachers and ICT professionals.

Key insights from his session included:

- Reinvesting in SACCOs to build long-term wealth through dividends and share accumulation.

- Fixed deposits as a low-risk, stable investment option for predictable returns.

- Exploring government securities such as Treasury Bills and Bonds for passive income.

- Investing in dividend-yielding stocks from companies like MTN, which have demonstrated strong shareholder payouts.

- Joint ventures and community projects, encouraging teachers to pool resources for sustainable enterprises.

- Essential investment principles: start small, manage time well, research before investing, diversify, and seek expert guidance.

Mr. Mukooba also reinforced the importance of personal finance management—budgeting, saving, debt management, and long-term planning—as foundational skills for financial independence. The session was highly interactive, with members actively engaging in questions and practical reflections.

Treasurer’s Report and Declaration of Dividends

The Treasurer, Madam Happy Immaculate together with the Secretary, Mr. Mukalele Rogers presented a detailed report covering:

- Total savings and shares accumulated in 2025

- Income and expenditure trends

- Status of the loan portfolio, which underperformed this year

- The impact of the reduced loan activity on dividend generation

Due to the marked drop in loan interest earnings, the SACCO declared a dividend rate of 5%, which is about a third of the 15% rate issued in 2024. Members were encouraged to:

- Take loans more actively,

- Repay consistently according to schedule, and

- Grow individual share capital to strengthen the cooperative’s stability.

Annual savings and dividends were then received by members.

Onboarding and Training on the Wendi Digital Wallet

Facilitator: Ronah Kusasiira – Pearl Bank

A hands-on training session was conducted to guide members through the Wendi Wallet, a modern digital finance tool designed to support both individual savings and SACCO operations.

Key outcomes included:

- Members successfully installed and registered on the Wendi application.

- Demonstration of how groups can save collectively on the platform.

- Guidance on requirements for SACCOs to qualify for Pearl Bank’s digital SACCO management system, offered free for qualifying cooperatives.

This session marked a major step toward ITAM SACCO’s digital transformation agenda.

Resolutions Passed

Members unanimously agreed on the following resolutions:

- Adopt Wendi Wallet as the official digital savings and transaction platform, utilizing its group-saving features immediately, as SACCO works towards obtaining the fully featured Management System for SACCO with guidance from Pearl Bank.

- Integration of the SACCO’s operations into modern digital tools for transparency and efficiency.

- Strengthening member mobilization efforts, with four new members joining during the AGM. SACCO to consider more financial literacy workshops

- Reaffirming the 2026 goals focused on:

- Growing share capital,

- Boosting the loan portfolio,

- Meeting targets set in prior AGMs.

- Identifying opportunities for smart, low risk investments.

AOB and Strategic Direction for 2026

During the open floor session, members discussed strategies to accelerate growth in 2026. A key proposal shared by the Secretary involved exploring opportunities for ITAM SACCO to invest in shares of another high-performing SACCO—one that delivered returns of over 80% last year.

While the idea was positively received due to its potential to boost ITAM SACCO’s income, several members raised concerns regarding procedural clarity, risk management, and due diligence. The matter was deferred for deeper evaluation and further discussion in subsequent meetings.

A Growing and Forward-Looking Community

The AGM concluded on an optimistic note, with members motivated to embrace new technologies, enhance financial discipline, and expand collaboration. The combination of governance, training, and strategic planning underscored ITAM SACCO’s progressive direction and commitment to empowering ICT professionals through cooperative action. As usual, a recap zoom session was also scheduled for other members from across the country who could not attend physically.

ITAM SACCO expresses gratitude to all members who attended and contributed to the success of the 5th AGM and Financial Literacy Workshop.